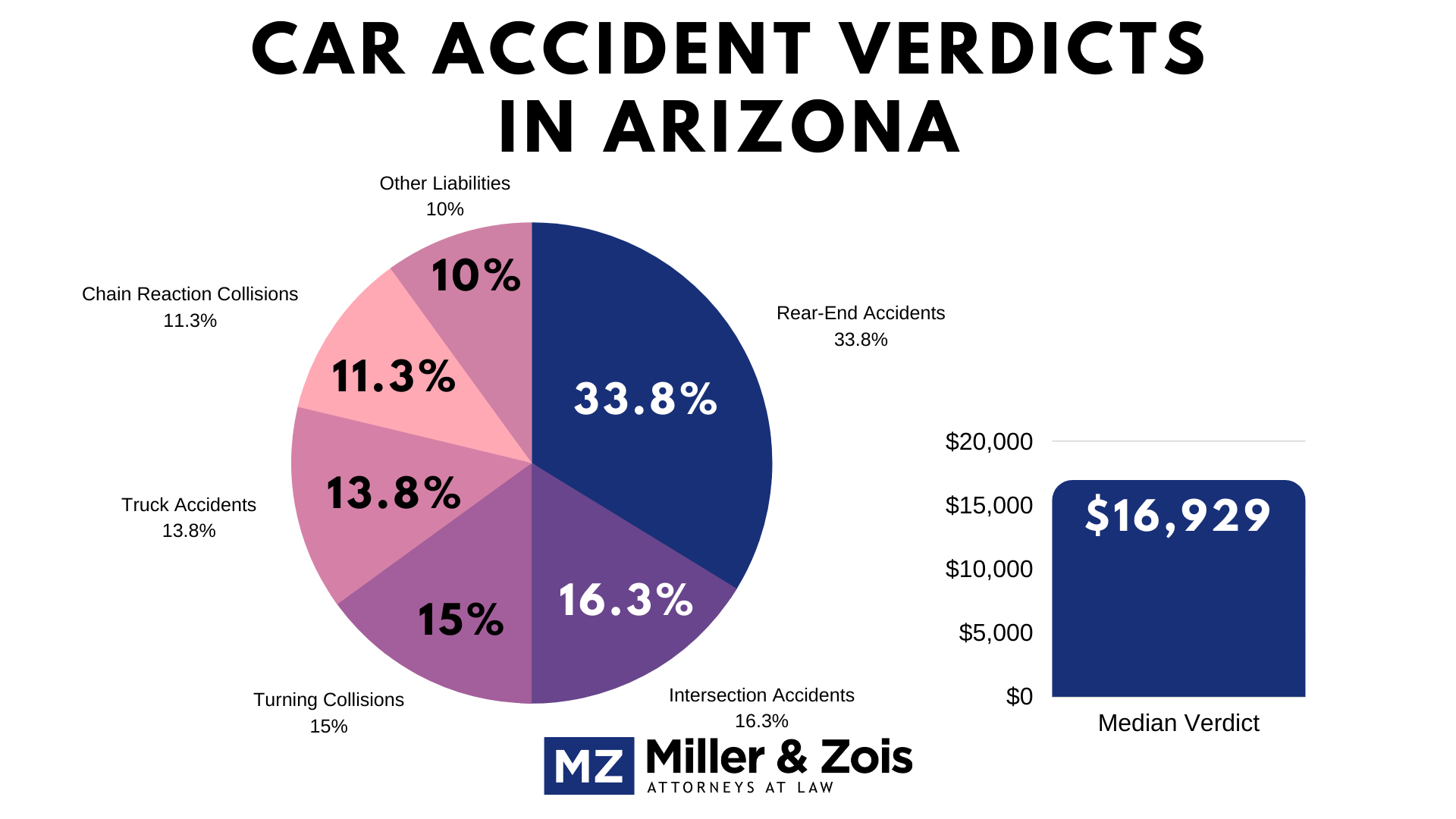

Jury Verdict Research found that the median money damage award in vehicle accident cases in Arizona is $16,929. Plaintiffs win money damages in 53 percent of cases that go to trial.

JVR also breaks down the type of accident: rear-end accidents accounted for 27 percent of the total number of plaintiff verdicts; intersection accidents accounted for 13 percent; turning collisions accounted for 12 percent; truck accidents accounted for 11 percent; chain reaction collisions accounted for 9 percent. All other liabilities made up 8 percent or less of the total.

I’m not sure why truck accidents were given their own category in these type of accidents. But this Arizona verdict data is interesting, and I think reflects the relative proportions of the different types of vehicle accidents nationally.

- Contrast Baltimore and New York

Arizona Car Accident Verdicts and Settlements

- 2024, Arizona: $25,000 Verdict. The plaintiff was driving east, stopped for a red traffic light at an intersection, and was rear-ended by the defendant suffering unspecified injuries. The case went to trial on the issue of damages only. The verdict included $8,111 for medical expenses.

- 2022, Arizona: $460,000 Verdict. A woman was T-boned. She suffered C5-C7 bulges and wrist nerve compression. The woman underwent a cervical fusion and a carpal tunnel release. She alleged negligence against the at-fault driver. The woman claimed he made an unsafe left turn and failed to yield the right-of-way. A Maricopa County jury awarded $460,000.

- 2022, Arizona: $180,000 Verdict. A man stopped at a red light. He was subsequently rear-ended by a police officer. The man suffered severe injuries. He alleged negligence against the City of Scottsdale. The man claimed he failed to timely brake and avoid a collision. A jury awarded $180,000.

- 2021, Arizona: $854,500 Verdict. A man and his daughter were rear-ended by a state trooper. The man injured his neck and back. He also sustained a concussion. The man’s daughter suffered minor injuries. He alleged negligence against the State of Arizona. The man claimed the state trooper drove at unsafe speeds. A Maricopa County jury awarded $854,000.

- 2021, Arizona: $981,908 Verdict. A 60-something truck driver was sideswiped. As a result, the truck rolled over and went off-road. The man suffered severe shoulder injuries. He alleged negligence against the at-fault driver. The man claimed he failed to safely operate his vehicle, timely brake, and avoid a collision. A Pima County jury awarded $981,908.

- 2020, Arizona: $153,829 Verdict. A man suffered unspecified injuries after a garbage truck sideswiped his dump truck. He sued the City of Tempe, the garbage truck’s owner. The man alleged that the garbage truck’s driver failed to stay in his lane. He sought compensation for his injuries, medical bills, pain and suffering, and mental anguish. The City of Tempe contested whether the collision caused the man’s injuries. A Maricopa County jury awarded the man $152,355. The man also received $1,474 in taxable costs. His net verdict totaled $153,829.

- 2020, Arizona: $220,994 Verdict. A vehicle struck a man’s vehicle as he attempted to exit a hotel parking lot. He sustained a torn left rotator cuff. The man sued the other driver, alleging that his failure to pay attention to the road caused his injuries. The other driver admitted liability but argued that the man was also comparatively negligent. A Maricopa County jury awarded the man $220,000. He also received $994 in taxable costs. However, fault apportionment reduced the net award to $198,994.

- 2019, Arizona: $10,000 Verdict. A 42-year-old woman suffered degenerative disc disease and the aggravation of her pre-existing disc herniations after her vehicle was rear-ended at a red light. She claimed she would need to undergo future fusion and decompression surgery because of her injuries. The other driver admitted liability but disputed the extent of the woman’s injuries. A Pima County jury awarded a $10,000 verdict.

- 2019, Arizona: $90,021 Verdict. A Ford F150 pickup truck drove out of a private driveway and struck a woman’s Honda Civic. She and her male passenger suffered undisclosed personal injuries. They sued the F150’s driver, alleging that his failure to yield the right-of-way caused their injuries. The F150’s driver admitted liability but disputed the passenger’s injuries. Following arbitration, the man received a $24,054 award. The Maricopa County jury also awarded a $30,500 verdict. The final judgment for the man amounted to $90,021.

- 2019, Arizona: $2,964,000 Verdict. A man suffered a traumatic brain injury and orthopedic injuries after a dump truck turned left and struck his vehicle head-on at an intersection. The man sued the dump truck’s driver and his employer. He alleged that the truck’s driver failed to yield the right-of-way. The defendants denied liability, alleging that a non-party motorist’s encroachment of the intersection caused the dump truck to make a wider left turn than intended. They also disputed the brain injury’s causes and extent. The Maricopa County jury determined that the man was 17.5 percent liable, the dump truck driver was 82.5 percent liable, and the non-party driver was 0 percent liable. They awarded a $2,964,000. The man’s net award was $2,445,300 based on liability apportionment.

- 2019, Arizona: $1,700,000 Settlement. A man suffered rib fractures, thoracic vertebrae fractures, a spleen laceration, and a dislocated right thumb after a truck struck his motorized wheelchair on the street. He sued the truck’s driver, alleging that he negligently operated his vehicle while eating and that he failed to maintain a proper lookout. The man also sued his employer for improperly training and supervising its drivers. This case settled for $1,700,000.

- 2019, Arizona: $7,000 Verdict. A woman suffered a traumatic brain injury, post-traumatic headaches, and a neck injury after her vehicle was rear-ended. She claimed that she sustained permanent injuries that left her with 25 percent bodily impairment. The woman sued the other driver for distracted driving, failing to maintain reasonable speeds, and failing to properly control his vehicle. The other driver admitted liability but disputed the injuries’ extent and causes. A Pima County jury awarded a $7,000 verdict.

- 2019, Arizona: $35,000 Verdict. A woman suffered unspecified injuries after her vehicle was struck at an intersection. She sued the other driver and the vehicle’s owner. The woman alleged that the other driver recklessly operated her vehicle and failed to yield the right-of-way. She also claimed that her injuries affected her work performance. The Maricopa County jury awarded her a $35,000 verdict.

- 2018, Arizona: $190,000 Verdict. A man suffered a torn left rotator cuff after his vehicle was struck head-on. He sued the other driver, alleging that he failed to drive on the right side of the road. The other driver admitted liability but disputed whether the collision caused the man’s injuries. A Maricopa County jury awarded the man $190,000.

What Impacts the Settlement Value of Arizona Accident Cases?

There are a handful of different factors that tend to drive the potential settlement value of auto accident injury cases in Arizona. The first and most significant factor is the nature and severity of the physical injuries suffered by the plaintiff. More serious injuries will have a much higher settlement value because they result in more pain and suffering and they usually generate more medical expenses.

Another factor, which is related to the severity of the injury, is whether the injury results in any type of permanent impairment or permanent disfigurement. An injury that results in a permanent limp, or a badly disfigured face, will have a significantly higher settlement value.

The next big factor in determining how much an auto accident injury case could be worth in Arizona is whether the defendant has auto liability insurance and the policy limits of that insurance. In smaller value cases this won’t necessarily matter. But in high value cases involving serious injuries, the policy limits of any available insurance can have a major impact. For example, let’s say you suffer a very serious injury that should be worth $1 million. If the at-fault driver’s insurance policy has a limit of $100,000, that is all you can get.

Arizona Car Accident Law

Below is a summary of some of the key points of Arizona law relevant to auto accident injury cases.

Statute of Limitations in Arizona Injury Cases

All states have statute of limitation laws that limit how long a potential plaintiff can wait before taking action and filing a lawsuit for a personal injury case. Arizona has its own statute of limitations that sets legal deadlines for filing tort lawsuits. If the plaintiff does not file their case before these deadlines expire, they will be permanently barred from filing.

Arizona has a general 2-year statute of limitations that applies to almost all types of personal injury cases, including auto accidents and medical malpractice claims Ariz. Rev. Stat. § 12-542. The 2-year SOL period begins to run when the “cause of action accrues.” What does this mean? For a car accident, slip and fall, or other simple type of personal injury case, the cause of action accrues on the same day of the accident/injury.

Claims Against the State Government

If you are suing the state government of Arizona (which includes counties and cities) you need to follow special rules and deadlines. Any tort lawsuit against the state (or one of its employees) must be filed within 1 year after the date the plaintiff was injured. (Ariz. Rev. Stat. § 12-821 (2024).) Claimants against the Arizona state government are also required to give the government special notice of their potential claim, in writing, within 180 days of the accident.

Arizona Follows Pure Comparative Negligence

In injury cases where the plaintiff was partly to blame to the accident that caused their injuries, Arizona follows a doctrine known as comparative fault for determining when the plaintiff can get damages. Under comparative negligence (also called “comparative fault”), each party is responsible for their own percentage share of fault in an accident and a plaintiff’s damages will be reduced by his or her share. For example, lets say Jane is in a car accident with John. John is found to be 70% at fault and Jane is 30% at-fault for the accident. Under comparative fault, Jane’s damages for the accident would be reduced by 30% to account for her share of fault. In other words, John would only be liable for 70% Jane’s loss. Ariz. Rev. Stat. § 12-2505

Arizona is a what is known as a “pure” comparative negligence state. Under pure comparative negligence, a plaintiff can recover some damages even if they are 80% or 99% at fault for an accident. By contrast, in a modified comparative fault system, plaintiffs are usually barred from recovering any damages if they are more than 50% at fault.

No Caps on Damages in Arizona

Many states have enacted statutory laws that impose maximum limits or “caps” on the amount of damages that plaintiffs can get in personal injury lawsuits. Arizona is uniquely plaintiff-friendly in this regard because maximum limits on tort damages are actually prohibited by the state constitution. Ariz. Const. art. 2, § 31

Arizona Uninsured Motorist Law

In Arizona, uninsured motorist coverage is optional, but insurance companies are required to offer it to policyholders. Drivers can choose to accept or decline this coverage. If purchased, the minimum limits for UM coverage typically match the state’s minimum liability coverage requirements, which are $25,000 per person for bodily injury and $50,000 per accident for bodily injury.

UM coverage provides financial protection by covering medical expenses and other costs when the other driver lacks insurance. It ensures that you are not left financially vulnerable due to another driver’s lack of insurance, offering peace of mind. However, UM coverage typically does not cover property damage unless specified in the policy, and there may be deductibles and policy limits that affect the amount you can claim.

Two statutory subsections of the Uninsured/Underinsured Motorist Act (UMA), Ariz. Rev. Stat. § 20-259.01, specifically govern uninsured motorist coverage and underinsured motorist coverage. These are outlined in Ariz. Rev. Stat. §§ 20-259.01(E) and (G). While uninsured motorist coverage can be subject to the terms and conditions of the policy, the subsection on underinsured motorist coverage does not allow for similar limitations. Uninsured motorist coverage addresses damages caused by a motor vehicle, whereas underinsured motorist coverage extends to damages resulting from an accident, without specific reference to a motor vehicle.

Ariz. Rev. Stat. § 20-259.01(D) provides the definition of uninsured motor vehicles. The UMA mandates that every insurer writing motor vehicle liability policies must offer underinsured motorist coverage, as stated in Ariz. Rev. Stat. § 20-259.01(B). The legislature’s intent was to ensure a broad application of underinsured motorist coverage, providing benefits up to the policy limits whenever the insured is not fully indemnified by the available liability limits. Any exceptions to underinsured motorist coverage that are not permitted by the statute are considered void.

Ariz. Rev. Stat. § 12-555 outlines a three-step process for handling underinsured motorist (UIM) claims when a settlement is not reached. Firstly, under § 12-555(B), an insurer is not liable for UIM benefits unless the claimant provides written notice of the UIM claim within three years from the date of the accident causing the bodily injury. Additionally, the claimant must either make a claim against the at-fault driver’s insurer or file a claim against the at-fault driver within the timeframe specified in Ariz. Rev. Stat. § 12-542 or the applicable statute of limitations if the accident occurred outside Arizona.

Secondly, as specified in § 12-555(C)(1), the UIM insurer must inform the claimant in writing that it will not be liable unless the claimant requests arbitration or files a lawsuit according to the terms of the insurance contract within three years of notifying the insurer of the UIM claim. The insurer has two years from receiving notice of the UIM claim to provide this written notice.

Stacking Uninsured Motorist Coverage in Arizona

The relevant provision in Arizona’s Uninsured/Underinsured Motorist Act regarding intra-policy stacking is found in Ariz. Rev. Stat. § 20-259.01(H). This statute outlines the method insurers must use to prevent insureds from stacking underinsured motorist (UIM) or uninsured motorist (UM) coverages. While insurers are permitted to limit stacking, they must comply with the statute’s notice requirement. This involves informing the insured of their right to choose one policy or coverage, either within the policy itself or through written notice provided within thirty days after the insurer receives notice of the accident.

Contact Us About Arizona Car Accident Claims

If you have been injured in an auto accident in Arizona, call our national auto accident attorneys today at 800-553-8082 or contact us online for a free case evaluation.

RELATED CONTENT:

Lawsuit Information Center

Lawsuit Information Center